world-class

financial education

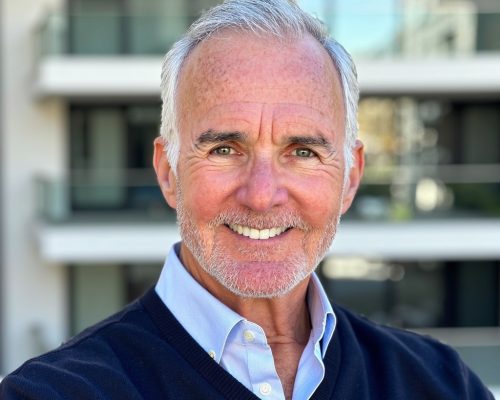

Globally awarded, expert-led financial education

for the education, business, and retail markets

who we serve

From those at home to classrooms & companies, MMU delivers world-class digital financial education for every audience & every age.

INDIVIDUALS &

FAMILIES

Real world financial education through engaging, non-complex lessons taught by experts. Designed to be simple, human, & deliver immediate & lasting real world value. From basic to advanced - we get you there.

SCHOOLS &

EDUCATORS

Plug-&-play expert-led financial literacy that engages students, saves teachers time, and improves scores. Includes ready-to-use lessons, guides, assignments, & reporting tools to support both educators & students.

BUSINESSES &

ORGS

Built to strengthen employee satisfaction and financial wellness. Options include licensing MMU, branded partnerships, & workshops.

business@mmuprograms.com

strategic advisory board

global recognition

There’s good reason why we’ve been consistently recognized globally in the field of education and learning.

offering snapshots

INDIVIDUALS & FAMILIES

We help teens, young adults, parents, & couples break free from financial stress and build clarity, confidence, and momentum for what matters most.

-

Stop feeling overwhelmed – understand and optimize budgets, pay down debt, start saving, investing, and more.

-

Make decisions you own – get crystal-clear on your values and align your finances with your life with expert goal setting workshops.

-

Turn worry into empowerment – replace fear of “what if” with a plan that works – “what if” it works?

-

Grow: build skills at any level – whether you’re brand new or an expert.

Don’t let “tomorrow” hold you back – take action & control of your future today.

SCHOOLS & EDUCATORS

World-class financial education that saves teachers time and transforms student outcomes

We partner with schools to bring engaging, expert-led financial literacy into the classroom. MMU goes beyond boring lectures – with interactive lessons, videos, quizzes, and workshops that students enjoy and remember.

Equip students with life skills – budgeting, credit, investing, and risk management become real tools, not abstract terms.

Reduce stigma & stress – money conversations become normal, approachable, and empowering.

Close equity gaps – every student, no matter their background, gets access to financial literacy.

Lighten the teacher load – ready-to-use modules, engaging content, and full support make teaching effortless.

Boost engagement & outcomes – students show up, participate, and improve both attendance and performance.

BUSINESSES & ORGANIZATIONS

Invest in financial clarity and culture –

for your team, mission, and bottom line

Money impacts every part of life. When employees feel confident with their finances, they bring that clarity and stability into their work. MMU helps businesses strengthen culture, improve retention, and support well-being through flexible financial literacy solutions.

Employee licensing – provide access to our award-winning platform for every hire or team member, boosting satisfaction and loyalty.

Strategic partnerships – create win-win programs that drive profit and impact for both your business and your people.

Workshops that connect – host engaging in-person or virtual sessions that empower employees to optimize and manage what they earn.

Better outcomes – reduce financial stress, improve decision-making, and align your team around a culture of confidence.

testimonials

Wolfgang F.

Student

A

Carolina F

Student

A